Company: Tata Chemicals

Agency: Bates

Brand Count :155

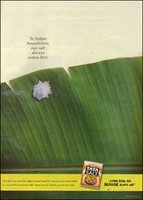

Tata salt is India's first branded salt. The story of this brand is interesting because the brand came as bye product. Tata salt was launched in 1983. Tata Chemicals  has their largest integrated chemical plant in Mithapur. The soda ash plant needed fresh water for their boilers. Hence to supply fresh water, the company started purifying sea water and it created high quality salt as a bye product in the process. This coincided with the government campaign with the support of UNICEF for promoting Iodised salt since iodine deficiency was a serious issue haunting the children's health.

has their largest integrated chemical plant in Mithapur. The soda ash plant needed fresh water for their boilers. Hence to supply fresh water, the company started purifying sea water and it created high quality salt as a bye product in the process. This coincided with the government campaign with the support of UNICEF for promoting Iodised salt since iodine deficiency was a serious issue haunting the children's health.

This environment gave birth of one of the super brands and a classic case of branding a commodity in the Indian market.

has their largest integrated chemical plant in Mithapur. The soda ash plant needed fresh water for their boilers. Hence to supply fresh water, the company started purifying sea water and it created high quality salt as a bye product in the process. This coincided with the government campaign with the support of UNICEF for promoting Iodised salt since iodine deficiency was a serious issue haunting the children's health.

has their largest integrated chemical plant in Mithapur. The soda ash plant needed fresh water for their boilers. Hence to supply fresh water, the company started purifying sea water and it created high quality salt as a bye product in the process. This coincided with the government campaign with the support of UNICEF for promoting Iodised salt since iodine deficiency was a serious issue haunting the children's health.This environment gave birth of one of the super brands and a classic case of branding a commodity in the Indian market.

The Indian salt market is estimated to be around Rs 1 Billion. The market is dominated by unbranded players. Tata salt have a market share of around 40% in the branded segment and 18% in the total market. The product salt is a low involvement and low value product with little scope of differentiation. Tata salt had the first mover advantage and was able to consolidate its position in the market thorough brand building.

1990 saw organised players eyeing the market. Captain Cook salt was launched in the market taking the " free flowing " feature as a differentiating factor. 1996 saw HLL extending its Annapurna brand to salts and positioning its brand on the platform of health and iodine content. 2001 saw the high profile launch of Dandi salt from Kunwar Ajay sari fame.Still 70% of the market is dominated by unbranded players.

Tata salt started its life positioning on the rational platform of purity. Since the corporate brand had the value of Trust engrossed in Indian consumer's mind, Tata salt was eagerly owned by the consumers. One of the major

factors that accelerated the growth of branded salt and Tata salt was the effective campaign by the government to promote iodised salt. The campaign penetrated the market to as deep as 20% and the first mover Tata Salt benefited most out of it.

factors that accelerated the growth of branded salt and Tata salt was the effective campaign by the government to promote iodised salt. The campaign penetrated the market to as deep as 20% and the first mover Tata Salt benefited most out of it.2002 saw the repositioning of Tata Salt on the platform of emotion. The brand owners felt that they should rise above the rational differentiation and try to emotionally influence the consumers. Hence Tata salt adopted its new tagline " Desh ka namak" translated " Salt of the nation". The brand is trying to associate itself to the nationalistic feeling of the consumers and is trying to fill a passion towards the brand. It is a herculean task for a brand that is in a category which is low involvement and low priced. To create involvement in such a category will be a tough task . But the campaign has raised the brand to new heights in terms of market share. Since customers usually are brand loyal and tend to use the same brand of salt every time ( convenience factor) , such high decibel campaigns helps in strong brand recall.

But the long term view of this category is challenging because the scope of differentiation has not been sustainable. There has not been any serious product development these years and this can recommoditise the category.The brand owners may have to think about value additions in the marketing mix to capture the 70% of unbranded segment.

source:tatasalt, superbrand, businessline, agencyfaqs,domainb